-

Korea.net's 24-hour YouTube channel

Korea.net's 24-hour YouTube channel- NEWS FOCUS

- ABOUT KOREA

- EVENTS

- RESOURCES

- GOVERNMENT

- ABOUT US

Most popular

- SocietyChina warmly welcomes first Korea-born giant panda Fu Bao

- PeopleFirst hearing-impaired K-pop act hopes for 'barrier-free world'

- CultureNovelist Hwang's 'Mater 2-10' shortlisted for Int'l Booker Prize

- SocietyExpats could account for 7% of population in 20 years: report

- SocietyNat'l Fire Agency picks 137 elite staff for deployment abroad

Featured Video

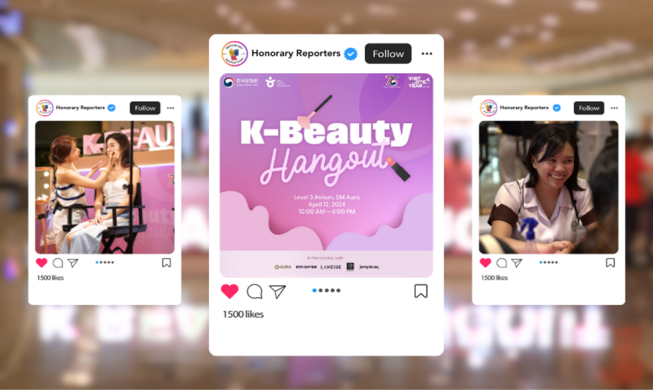

Event 'K-Beauty Hang Out' draws hundreds in Philippines

John Paul Serraon

My visit to this year's Bologna Children's Book Fair in Italy

Daniela Astolfi

Northwestern Seoul district hosts cherry blossom festival

Dhanisa Kamila

Government

Policies

Events

Musical 'Paganini'

Apr 06, 2024 ~ Jun 02, 2024

All Roads Lead to History, Italy and Korea

Feb 26, 2024 ~ May 06, 2024

2024 K-Royal Culture Festival

Apr 27, 2024 ~ May 05, 2024