Press Releases

Introduction of Special Treatment in KRW Transactions for ICSDs’ Omnibus Account

Ministry of Economy and Finance

Jun 26,2024

With the opening of the omnibus accounts of Euroclear Bank and Clearstream Banking on Thursday, June 27th, the international central securities depositories (ICSDs) will begin to offer global depository and settlement services for Korean Treasury Bonds (KTBs) and Monetary Stabilization Bonds (MSBs). As the two leading international central securities depositories launch operations in Korea, it is expected to greatly enhance the convenience of FX transactions for foreign investors in Korea’s sovereign bond market.

To accommodate the needs of foreign investors, the Ministry of Economy and Finance has set up special measures to further liberalize KRW transactions by investors using the omnibus account, in an effort to make KTBs trading more accessible and bring the convenience of trading to a global level.

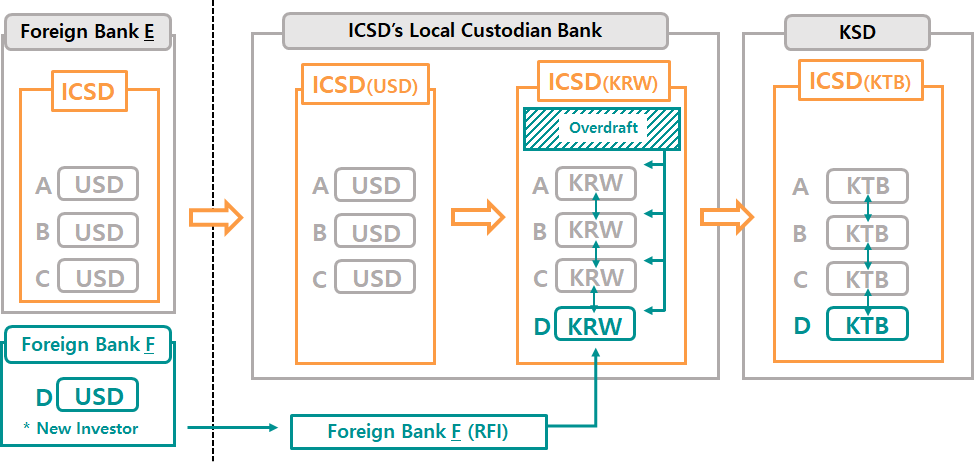

First, third-party FX via RFIs, which will officially operate from July 1, will be fully liberalized.

The introduction of the RFI system, set for implementation on July 1st, is to enable foreign investors to conveniently exchange KRW via their preferred foreign financial institutions at more competitive rates. While foreign investors are expected to use their own KRW accounts opened at Korean FX correspondent banks in advance, those who have their accounts with Euroclear Bank and Clearstream Banking* will be able to use ICSDs’ KRW accounts without the need of opening their own KRW accounts. This change will make it easier for new investors to access Korea’s sovereign bond market, particularly those who have never opened their KRW accounts in Korea.

* Includes beneficial owners who use the ICSD system via participants of the ICSDs

Second, over-the-counter trading and settlements within ICSDs will be easier.

FX regulations on internal settlements and internal book transfer, when foreign investors trade KTBs internally and make other transactions like repo, will be lifted. Investors who have their accounts with Euroclear Bank and Clearstream Banking will be able to settle their trades within the same ICSDs internally, using KRW.

Third, overdraft of KRW via ICSD will be allowed.

KRW overdrafts to foreign investors for securities settlement purpose were liberalized last March, and this will be expanded to the cases where investors receive overdrafts via global custodians and ICSDs who offer omnibus accounts to their customers. As a result, investors will be able to borrow KRW directly from the ICSDs, and also, new investors without their own KRW accounts already opened in a Korean domestic bank are expected to particularly benefit from this change.

The Ministry has issued an administrative notice from June 17th to 27th for above-mentioned amendments to the Foreign Exchange Transactions Regulations and the Guidelines on Foreign Exchange Affairs of Foreign Financial Institutions. The revised regulations and guidelines will come into effect on Friday, June 28th. Additionally, the Ministry is committed to continue to engage in consultations to ensure these special measures are incorporated into the ICSD system as soon as possible.

|

REFERENCE |

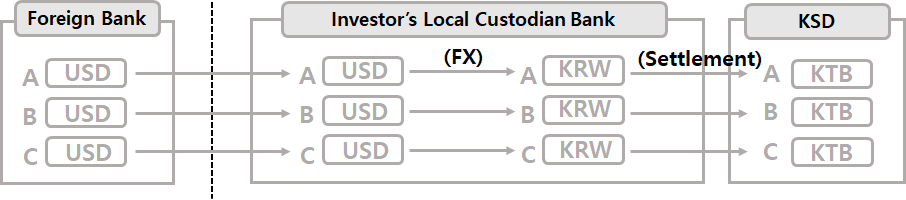

FX Transactions and Settlement Procedures for Foreign Investors Trading KTBs |

1. Before Introducing Omnibus Account

|

|

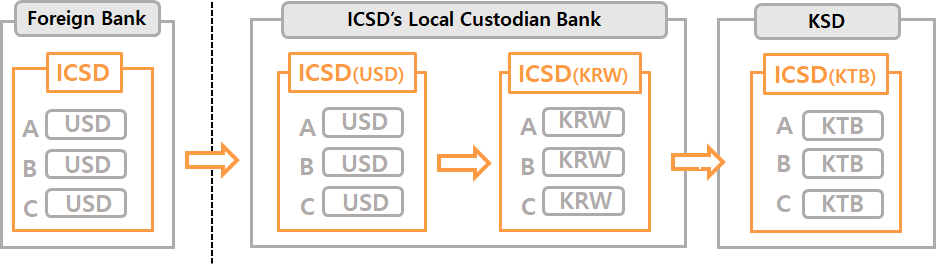

2. After Introducing Omnibus Account

|

|

3. After Implementing Special Treatment in KRW Transactions

|

|

Please refer to the attached files.

Most popular

- Korea and Cambodia Launch First Article 6.2 Climate Project

- MOFA Spokesperson’s Statement on the Military Clash between Thailand and Cambodia

- Inargural Speech of the Minister of Health and Welfare

- Real Gross Domestic Product: Second Quarter of 2025 (Advance Estimate)

- Vice Minister Kim Jina Meets with U.S. Deputy Secretary of State for Management and Resources Michael Rigas